Bitcoin's price has exceeded the November 2021 $65,000 barrier, thanks to a spike in their spot ETFs' demand. If you've ever been put off by the tricky process of buying cryptocurrencies like Bitcoin, the introduction of Bitcoin Spot ETFs is a game-changer for the average investor. This article offers you a balanced view of the change to help you on your pre-trade research, without pushing you one way or the other. If you're all ready to jump in, we've got a "Trading Guide" section at the end. But first, let's get down to brass tacks:

Introduction to Bitcoin Spot ETFs

Pros and cons of Bitcoin Spot ETFs

Current Trends and Future Prospects in Bitcoin Spot ETFs

Introduction to Bitcoin Spot ETFs

What exactly is a Bitcoin Spot ETF?

A Bitcoin spot ETF is a tool that simplifies investing in Bitcoin for individuals. The United States Securities and Exchange Commission approved the first batch of 11 Bitcoin spot ETFs in the United States on January 10, 2024, marking another step forward following the listing of Bitcoin futures ETFs in 2021. Unlike futures ETFs, which rely on futures contracts, Bitcoin spot ETFs' underlying are Bitcoins. This means you can enter in the Bitcoin market indirectly through your brokerage account without the hassle of complex buying and storage processes involved in holding them directly. Although there are certain management fees and commissions, this method is arguably more convenient than buying and selling Bitcoins directly.

How Do Bitcoin Spot ETFs Work?

The operation of Bitcoin spot ETFs is quite clever: Buying and then securely storing Bitcoin in trusted digital vaults overseen by professional custodians (usually unrelated to the ETF manager), and moderate an ETF's price share to reflect that of Bitcoin's by authorized participants ("APs", financial institutions).

Their goal is to track Bitcoin's market price. Initially, the ETF purchases Bitcoin on the market or through specific cryptocurrency exchanges, and these Bitcoins are then stored in digital wallets with protective measures like cold storage, where Bitcoins are kept in offline devices to reduce the risk of theft by hackers.

After acquiring a certain amount of Bitcoins, a Bitcoin spot ETF issues shares based on the amount of Bitcoins it holds. The price movements of these ETFs' shares are meant to reflect the real-time market price of Bitcoin, so bulk shares of a Bitcoin spot ETF are created and redeemed by APs for that, who in turn seek profit from arbitrages.

What Does This Mean for Individual Investors?

With this setup, the actual process of acquiring a share of a Bitcoin spot ETF becomes as straightforward as buying stocks or other ETFs with liquid and trading efficiency that would normally be better than non-listed products. So, both institutional and individual investors can dive into Bitcoin investment comparatively easily without worrying about the technicalities and security challenges of directly managing crypto wallets or safeguarding private keys.

Pros and Cons of Bitcoin Spot ETFs

Benefits:

Convenience: Significantly simplifies the crypto market entry process. Direct handling of crypto wallets or navigating complicated exchange issues is a matter of the manager and the custodian, making it accessible for average investors.

Liquidity: The convenience of buying and selling through one's existing brokerage accounts means the liquidity of the Bitcoin market could be higher comparatively after Bitcoin spot ETFs has been approved in the US.

Regulatory Protection: ETFs undergo strict regulation, offering more transactional transparency and security compared to the uncertainties of direct Bitcoin purchases.

Drawbacks:

Volatility: Bitcoin's price is highly volatile, introducing significant risk. While ETFs simplify the process of investing in Bitcoin, they do not mitigate the market's inherent unpredictability.

Regulatory Uncertainty: The crypto market's regulatory landscape is still evolving, presenting risks related to fraud and manipulation. Future changes in regulations could also affect ETFs.

Security Risks: Storing large amounts of Bitcoin makes ETFs potential hacker targets. Despite security measures like cold storage, hacking threats and forking disputes remain, with slim recovery chances for stolen Bitcoins.

Management Fees: Investors avoid the direct purchase and storage hassles but incur management fees, potentially higher than those for traditional stock ETFs due to cryptocurrency transaction and security costs.

Tracking Error: ETFs aim to mirror Bitcoin's market movements closely; however, potential pricing discrepancies mean returns might not fully match Bitcoin's actual market performance.

Current Status and Outlook for Bitcoin Spot ETFs

Initially, the growth of Bitcoin spot ETFs wasn't particularly striking, but within just a couple of months, they quickly attracted over $7 billion of inflows, significantly ramping up the demand for the token. Bloomberg Intelligence analyst James Seyffart forecasted that these ETFs might attract a total of $10 billion in capital within their first year, and they could potentially exceed this estimate. Since the beginning of the year, Bitcoin's value has risen more than 45%, reaching $65,010 on March 4th - the first time it surpassed the $65,000 mark since November 2021.

The upcoming Bitcoin halving event is also a key driver behind the recent price surge. Simply put, Bitcoin halving is a rule within the Bitcoin system that occurs every four years, cutting the Bitcoin rewards for miners in half. This mechanism is designed to control the growth of new Bitcoin supply and maintain its scarcity, similar to how gold mining becomes increasingly difficult, aiming to prevent inflation of value. Historically, Bitcoin's price has significantly increased after each halving event, as seen in 2012 and 2016. However, this is not a guaranteed outcome. The next halving is expected around April 2024, and many investors and analysts view it as a potential market catalyst that could positively impact Bitcoin's price again.

While predicting Bitcoin's price movement in the coming months is still premature, when the total supply of Bitcoin is capped at 21 million is coupled with an increasing number of financial products and growing investor interest, that is sure to have a certain impact on its price. Though, some mainstream platforms like Vanguard have yet to offer their Bitcoin spot ETFs, more people are sure to become aware of SEC's already approved Bitcoin spot ETFs.

It's important to note that Bitcoin spot ETFs differ significantly from the ETFs commonly seen on trading platforms like Tiger Trade. Traditionally, ETFs holding stocks of listed companies are considered lower risk over the long term because they invest in tangible companies that can adjust their holdings according to the market. However, the risk associated with Bitcoin spot ETFs is closely tied to Bitcoin's market performance; if Bitcoin's price plummets, the ETFs would also suffer. Therefore, if you're interested in Bitcoin ETFs, it's advised to do thorough research and proceed with caution. Additionally, it's wise to listen to a range of opinions and make investment decisions based on your own circumstances and risk tolerance.

Trading Guide

Before diving into trading, there are a few points you should be mindful of:

Will Bitcoin Spot ETFs Affect Bitcoin's Price? ETFs don't directly alter Bitcoin's price but can have an indirect impact. For instance, they can increase Bitcoin's acceptance, boost market recognition, stimulate active trading, and possibly reduce the purchasing costs for institutional investors. Consequently, they can attract more investors, elevate Bitcoin's status, and may lead to more transactions and volatility, indirectly influencing the price.

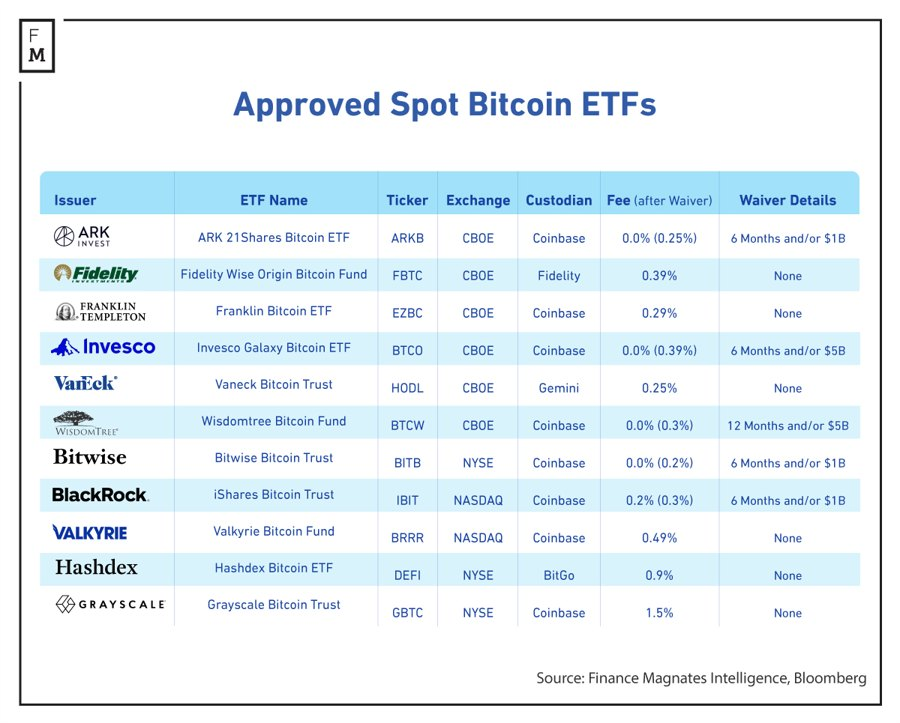

Do Bitcoin Spot ETFs Carry Custodial Risks? Yes, ETFs store Bitcoin with third-party custodians, with most opting for Coinbase, while others like Fidelity uses their related custodian entity and VanEck chose Gemini. Should the custodian, say Coinbase, encounter issues (such as financial difficulties or cyberattacks), your investment's safety could be at risk. Although there are ways to recover Bitcoin, they might not be swift or straightforward, making it important to consider custodial risks.

Do Bitcoin Spot ETFs Offer Dividends? No, there is no dividend, since Bitcoin itself does not generate any income. Profit of a Bitcoin spot ETF can only be realised with upward price movements of Bitcoins.

Is There a Minimum Investment for Bitcoin Spot ETFs? You can start investing with just one share, though you will need to be mindful of transaction fees.

With the information provided above, on Tiger Trade, you (excluding residents within Mainland China) can now trade all 11 Bitcoin spot ETFs. You can begin by searching for the ETF tickers you're interested in on Tiger Trade. Add them to your watchlist to track their performance over time before making your investment decision:

The following list outlines the fees and corresponding promotional policies for these 11 ETFs, allowing you to choose based on your needs:

Of course, before making any investment, your research should not stop here. Beyond assessing your own goals and risk tolerance, you should also delve into detailed information about the ETFs, including:

Visiting the official websites of the ETFs to gather key data and information about the fund managers, custodians and APs;

Reading reviews and news articles about the fund, its managers, its custodians and its APs;

Paying attention to other details that might influence your decision-making process.

Ultimately, whether this or any other investment is right for you to invest depends on you. The more comprehensive the information you have, and the better prepared you are, could mean the wiser the decisions you will make.

Disclaimer: Virtual assets are innovative products, and their intrinsic value and future is unpredictable. Trading them carries a high level of risk and may not be suitable for all investors. This is not financial advice and should not be regarded as a solicitation or recommendation for acquiring or disposing of financial products. Any content being discussed, shared, and commented does not consider your own investment objectives or financial needs. Tiger Brokers assumes no warranty or responsibility for the accuracy and completeness of the information. Past performance is no guarantee for future results. Graphics and charts are for illustrative purposes only. Please read our Disclosure Statements and Terms and Conditions available on our website, and consider whether acquiring or continuing to hold financial products is suitable for you before opening an account or making investment decisions. Find out more at: www.tigerbrokers.nz. TIGER FINTECH (NZ) LIMITED (8187510)